How to Handle Black Tax As An African Entrepreneur

On one episode of a popular Ghanaian podcast, Sincerely Accra, a young man in his mid-thirties shared how he and his brother were given to their aunt’s care by their parents when they were much younger. The aunt already had many children and having two new mouths to feed caused such a strain on her finances that the older one had to take on the responsibility of caring for himself and the younger brother immediately after he started earning. He has since cared for his younger brother’s needs, including school fees, feeding, accommodation, and other necessities. He reported that his younger brother spent more time in chapels than he did studying and expressed his pain and fears that the sacrifices he had made may amount to nothing considering his brother’s nonchalance toward his education and future.

Black tax is a term used to describe the practice of people who have risen to certain professional status providing support and assistance to other members of their families, even to distant relations.

Family is a significant part of society, and in many African countries, families share close ties. It is common for families to meet to agree on certain decisions. For example, funerals and marriages. Families are committed to helping and supporting each other through misfortunes as much as they gather to celebrate. It is noble for families to support and build each other up.

The issue, however, is when more successful family members become burdened with the obligation of providing for more people than their finances can bear. There is usually a sense of entitlement that develops as families not only expect but also demand all forms of assistance from their more successful members. And when these expectations fail, bitterness, anger, and hatred begin to brew on both sides. These “more successful” members are sometimes merely people who have traveled overseas, graduated from university, or own a car. They may not necessarily be in a position to take on financial responsibilities for other people, a fact that many seem to be oblivious to.

As an entrepreneur, you may be even more highly esteemed. You own a business. Some relatives may believe that you should be able to employ your cousins. You should send some goods home to your uncle and his wife at the end of every month. You should be able to pay your nephew’s school fees. Are you able to? Is your business able to?

Many businesses struggle to grow because of financial misappropriations and unqualified human resources. Some family members may overestimate the state of your business and have unrealistic expectations of you as a result. It is up to you to make decisions in the best interest of your business.

Here is something to consider if you want to be able to build your business without black tax getting in the way:

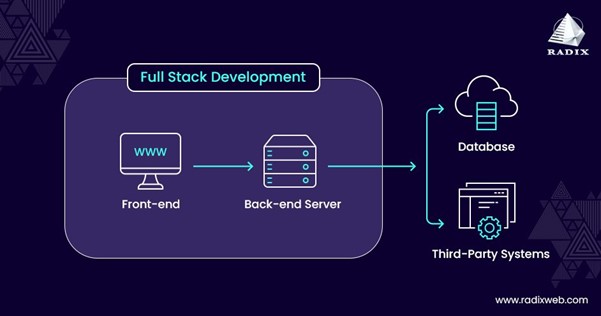

Set systems and checks in place

The first thing to note is the business entity concept. The business entity concept states that transactions associated with a business must be recorded separately from those of its owners or other business entities.

With this concept in mind, no amount of pressure will drive you to mismanage the assets of your business. It guides you against taking money out of the business wallet to spend on family charity missions.

Keeping clean records of all transactions informs you about the expenses and revenue streams of the business, and with that information, you can make realistic projections for your business.

If you must, create a social support account for the business to keep a percentage of revenue every month for donations. That account caters to family financial responsibilities and the like. Be disciplined enough not to use money from other accounts once the funds are exhausted.

Hiring family and friends

Black tax is not only in cash. It could also be in kind. For instance, once your nephew graduates from university, you will be expected to employ him at your company. Neither his parents nor other family cares about his qualifications. Their only thought is AB owns a business and can provide a job for his nephew. It will be unfair to generalize the mistakes of some family members who have failed as employees. If you can find a family member who is open-minded, professional, and qualified in terms of skills-set and knowledge, you may have found the best person for your business. The family has a higher likelihood of having the interest of your business at heart as it may be personal for them to some extent.

However, you must not employ a family member just because of the mere fact that they are family. Do it while keeping the success of your business in mind. If a family does not meet your hiring criteria, do not hire. Learn to separate personal matters from professional matters. And if you happen to employ a family member, make them understand that once you get to work, it is a different ball game. Do not mix business with pleasure, especially not in this regard.

Develop a sustainability plan

What is the big picture? Ultimately, what kind of business do you wish to own? Draw the big picture and discuss with your team and other successful people how you can achieve it. Knowing what you want keeps you in check. So, get the big picture and set SMART and sustainable goals toward it. Your everyday actions and decisions will lead you to your goals. Those successes will then eventually move you toward the big picture.